Author: Ruben Singh Phagura

Illustations and Charts by Bravos Research

Date: April 2, 2025 - April 20, 2025

Introduction

After the 20% drop in US stock market value, as measured by the S&P 500, the market has recovered about half of its losses following a 90-day pause on tariffs. But will this rally hold over time?

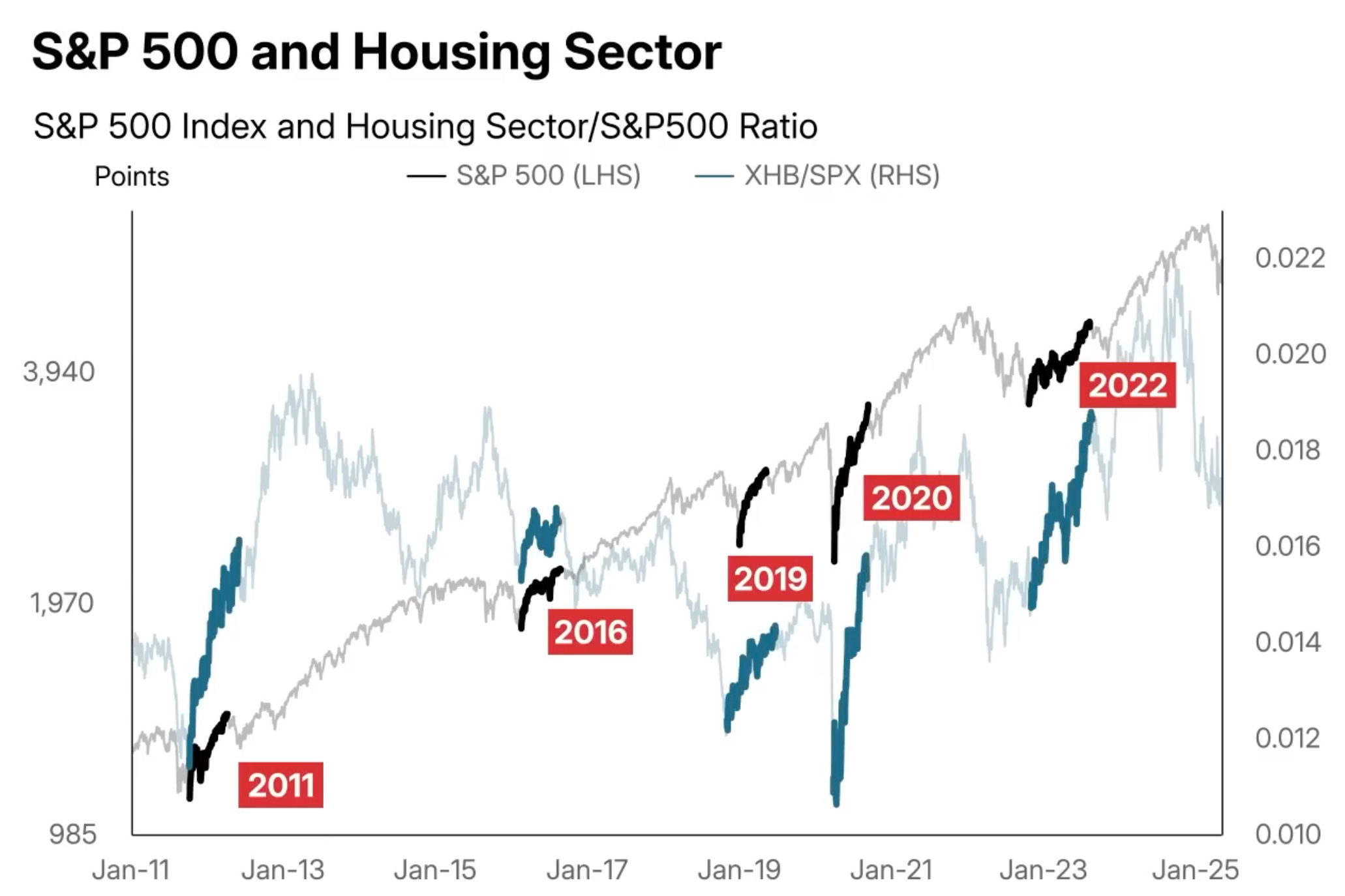

The US housing market has been falling since February 2025. You might ask, why compare the stock market to the housing sector? The housing market is a great indicator of liquidity and broader economic conditions. A rising housing market typically occurs when people are buying homes, which is enabled by banks lending money for people to purchase homes and consumers being financially stable. These factors provide insight into the economy’s health. To explore this, I am using the homebuilding sector, specifically the ratio XHB/SPX written as (RHS), to measure how the housing market is performing relative to the broader stock market.

A historical pattern is clear. With every recovery (In black) has occurred alongside a strong housing market. on the other hand rallies in 2022, when the housing market was underperforming ailed to sustain themselves.

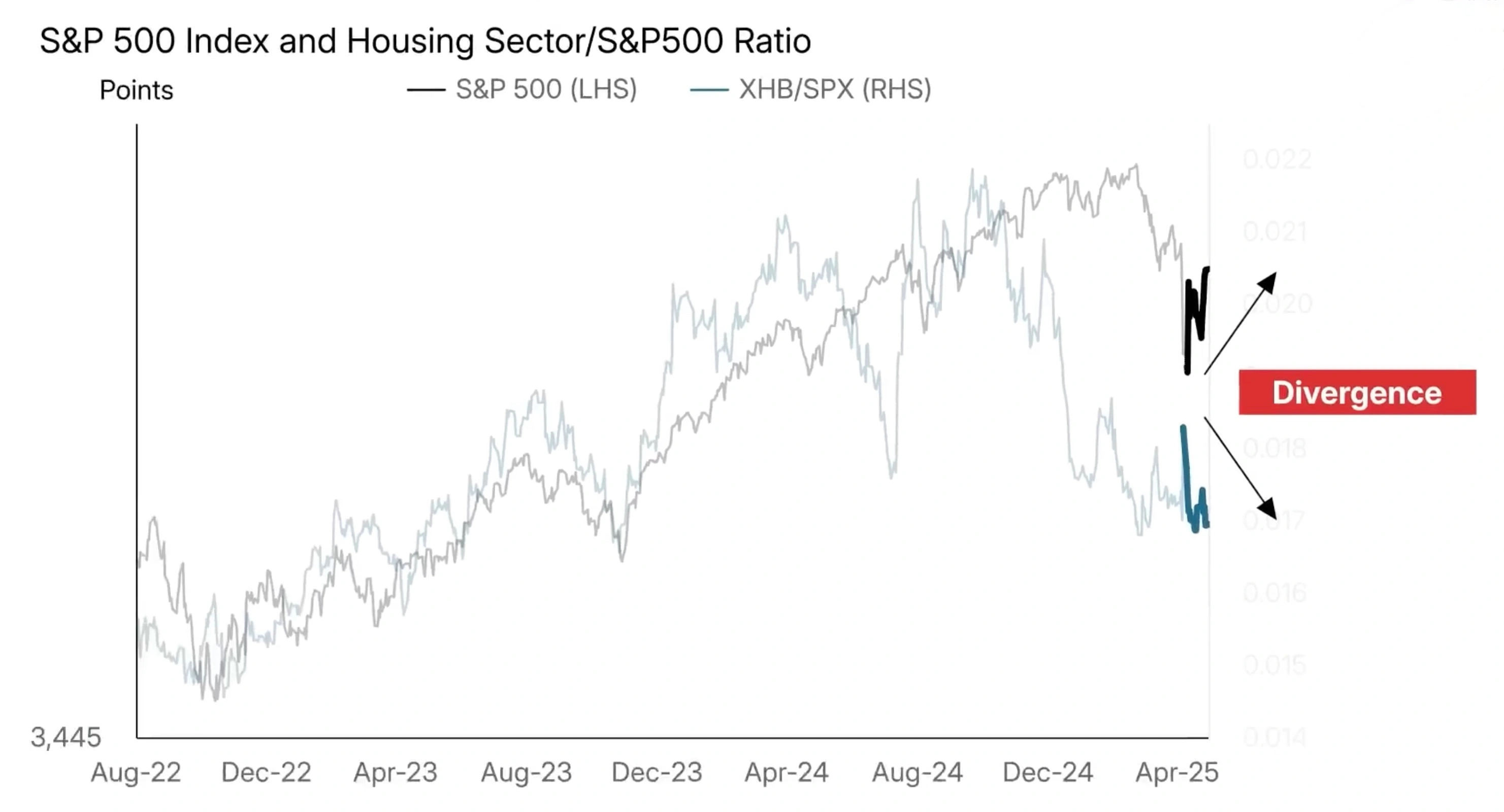

Despite powerful market movements, the housing market has been falling sharply. This divergence between the stock market and housing suggests the recent rally may fall short of expectations. This isn’t just a small discrepancy — it’s a significant divergence, similar to the one observed during the 2011 European financial crisis, where the housing market provided an early warning system.

This also led to an outperforming housing and stock market months after the crisis, hinting at an underlying economic weakness. It suggests the market might not reach new all-time highs anytime soon.

In the graph above, when we overlay the S&P 500 performance, we can see some similarities to past periods but also significant differences. This suggests that we may experience choppy markets over the next few months, though this could eventually lead to a strong recovery, as seen in 2012.

Geopolitical Tensions and Market Confidence

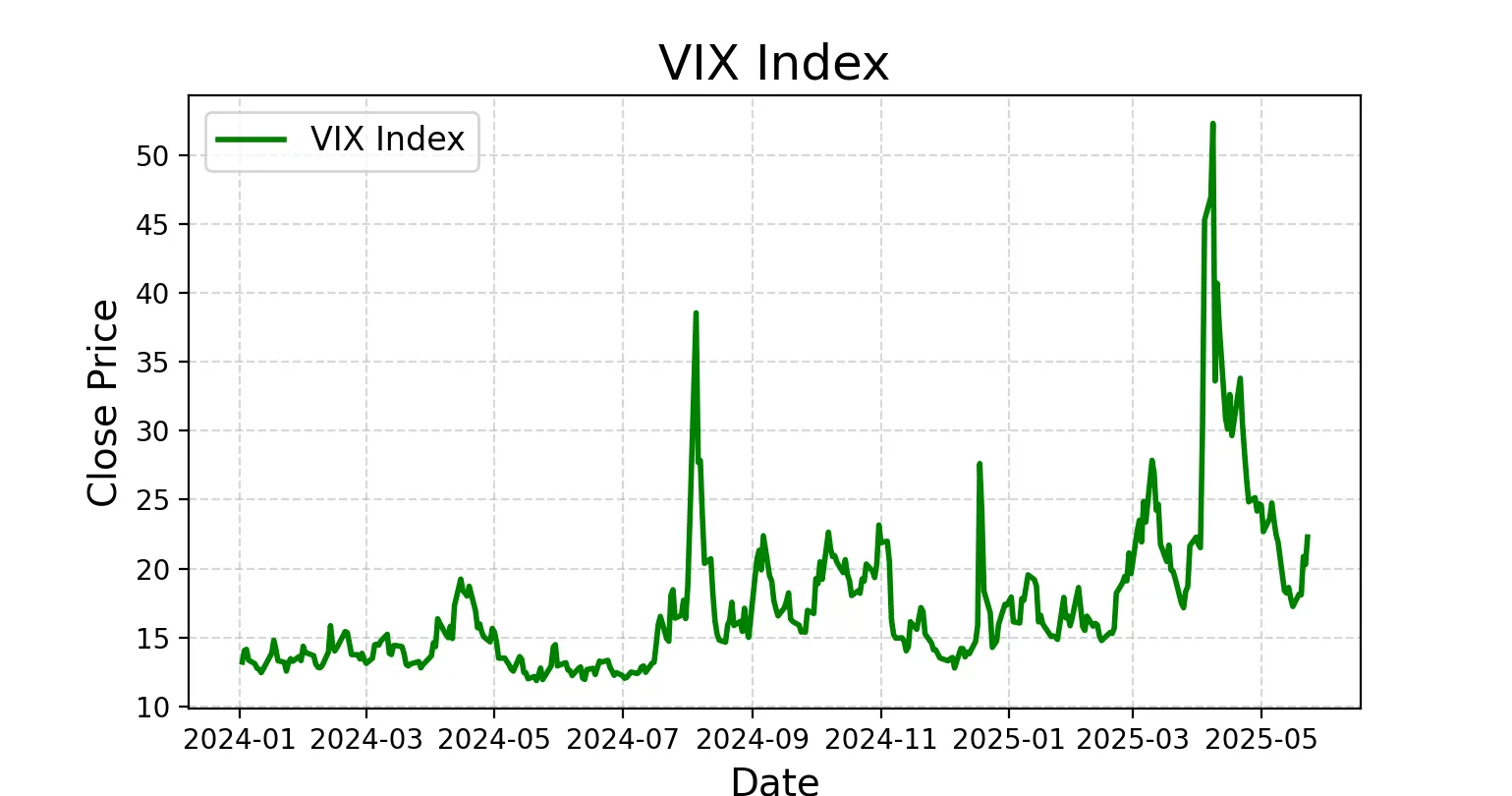

Current geopolitical events, such as wars and sanctions, continue to erode investor confidence. These tensions can disrupt markets by increasing uncertainty, which in turn raises volatility and reduces the willingness of investors to take risks. This can be seen in the VIX index shown in the image above as a spike in volatility emerges in the market around times of tariffs and geopolitical events.

In addition to direct economic impacts, political instability can also impact global supply chains, leading to disruptions that further contribute to economic slowdown. Given the nature of geopolitical crises, such as the ongoing tensions between major world powers, it is essential to consider how these events may influence market recovery.

Inflation and Interest Rates

Inflation continues to pose a significant challenge for the market. Central banks, particularly the Federal Reserve, have raised interest rates in an attempt to control rising prices. However, these rate hikes have also led to higher borrowing costs, which can stifle economic growth.

Impact on Growth Higher interest rates reduce the purchasing power of consumers and increase the cost of capital for businesses. These factors typically lead to slower economic activity and, in some cases, a recession. While higher rates are designed to curb inflation, they also dampen economic activity, which could delay the market recovery.

Chart Example: Inflation vs. Interest Rates

This chart clearly shows how central bank actions can influence market sentiment. The correlation between high inflation and rising rates suggests that the economic headwinds could persist for some time.

Historical Context

To understand the current situation, it’s helpful to look at past downturns. Historical events, such as the 2008 financial crisis and the COVID-19 pandemic, offer lessons on how markets recover.

In the case of the 2008 crisis, it took years for markets to return to pre-crisis levels, and the recovery was largely driven by government stimulus and low interest rates. Similarly, the COVID-19 crisis led to a sharp decline, but unprecedented fiscal and monetary support helped markets rebound.

In contrast, the current environment is different. We’re not seeing the same level of stimulus, and inflationary pressures are adding complexity to recovery efforts. This suggests that, while recovery may eventually happen, it will likely take longer and be less robust than the post-2008 or post-2020 recoveries.

Conclusion

The recent rally in the stock market is not necessarily a sign of a full recovery. While the market has bounced back from its recent lows, the ongoing weakness in the housing market, geopolitical risks, and inflationary pressures all point to a prolonged period of market uncertainty.

If history is any guide, the current environment suggests we may see choppy markets in the coming months, with a potential for further declines. A true recovery, one that leads to new all-time highs, may still be far off.

- Bravos Research: (https://bravosresearch.com)